About

Role and Responsibilities

The Environmental Markets Board has been established to oversee the governance framework for participating Environmental Markets in the UK.

The Board has been appointed during a critical phase of development and initial operation of three pilot markets:

In this initial stage of market operation, the Environmental Markets Board has been established as an Interim Board within Wessex Water Limited. The intention is that the board will, in time, become a separately incorporated entity.

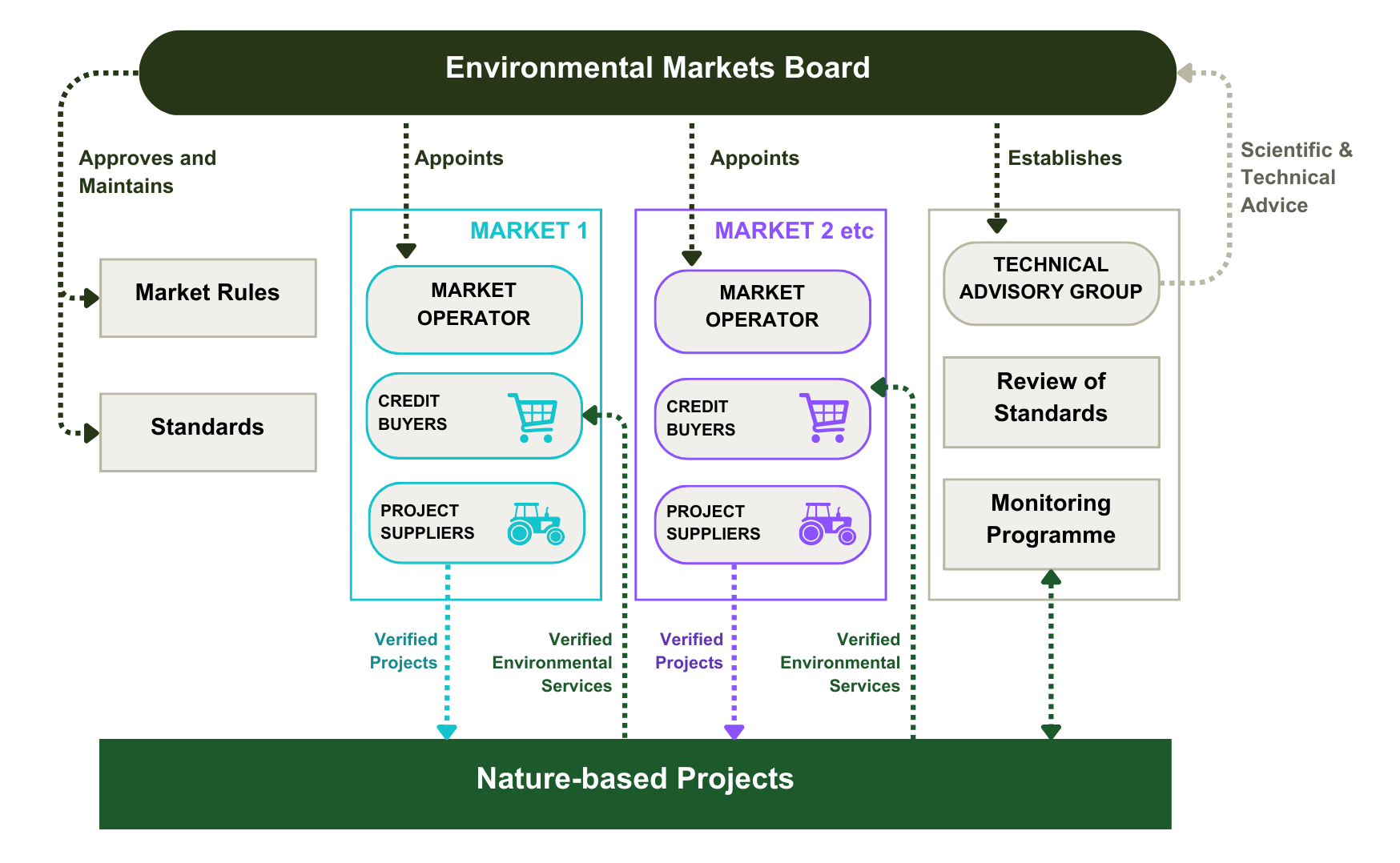

The role of the Board in relation to key market stakeholders is summarised in the following diagram.

The insights and experience of the Board over the next 12 months will be a source of advice for governments and regulators about how markets should be governed and regulated.

Find out more about the Board Members and Terms of Reference.

Funding

The Environmental Markets Board is funded by Buyers and Suppliers in the Markets it oversees. A Governance Fee is charged on trades in each Market Round. The Governance Fee is published in advance in the Market Opportunities Statement for each Market Round.

Following Market Settlement the Governance Fee is deducted from the market surplus and provided to the Board to fund its Governance activities, including the Scientific Advisory Group which provides scientific and technical advice to the Board.

In the period before the Interim Board becomes an incorporated entity, if there is any shortfall in funding, the remainder will be made good by Wessex Water Limited.

Context

The role of markets in accelerating private investment in nature-based solutions in the UK was examined by the Broadway Initiative in 2020.

In 2021, in response to the Government’s Green Recovery Challenge to Water Companies, Wessex Water offered to test and demonstrate how Environmental Markets might work in practice, building on its experience with nutrient trading in Poole Harbour.

In June 2022, the Financing Nature Recovery UK initiative set out a framework for high-integrity Environmental Markets that outlined the need for institutional architecture to ensure that market rules, standards and accreditation processes are developed and applied in a transparent and predictable way in order to build and maintain investor confidence.